- Services

- Tools

-

Sourcing

-

Distribution

-

Freight

-

Supply Chain Management

Refer to teammate

We'll never share your email with

anyone else.

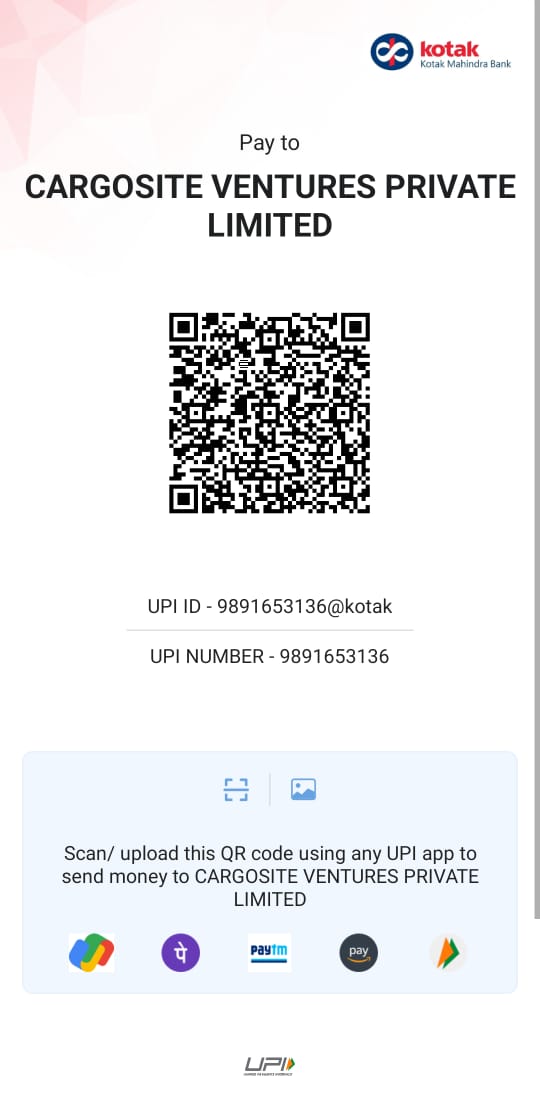

Pay By QR